Business Use Of Home Deduction 2024

Business Use Of Home Deduction 2024 – In tax year 2024, the Earned Income Tax Credit (EITC), which gives lower-income workers a tax break, is also a bit higher than in 2023. For qualifying individuals with three or more children, that tax . The Internal Revenue Service (IRS) has just released the updated income tax brackets for 2024, enabling individuals .

Business Use Of Home Deduction 2024

Source : www.youtube.com

Lower Your Taxes Big Time! 2023 2024: Small Business Wealth

Source : www.walmart.com

25 TAX DEDUCTIONS for Home based Food Businesses 2024 [ FULL

Source : www.youtube.com

Lower Your Taxes BIG TIME! 2023 2024: by Botkin, Sandy

Source : www.amazon.com

home based business tax deductions 2024 [ How Much Can You Write

Source : m.youtube.com

Lower Your Taxes BIG TIME! 2023 2024: Small Business Wealth

Source : www.amazon.com

Lower Your Taxes Big Time! 2023 2024: Small Business Wealth

Source : www.walmart.com

home based business tax deductions 2024 [ How Much Can You Write

Source : m.youtube.com

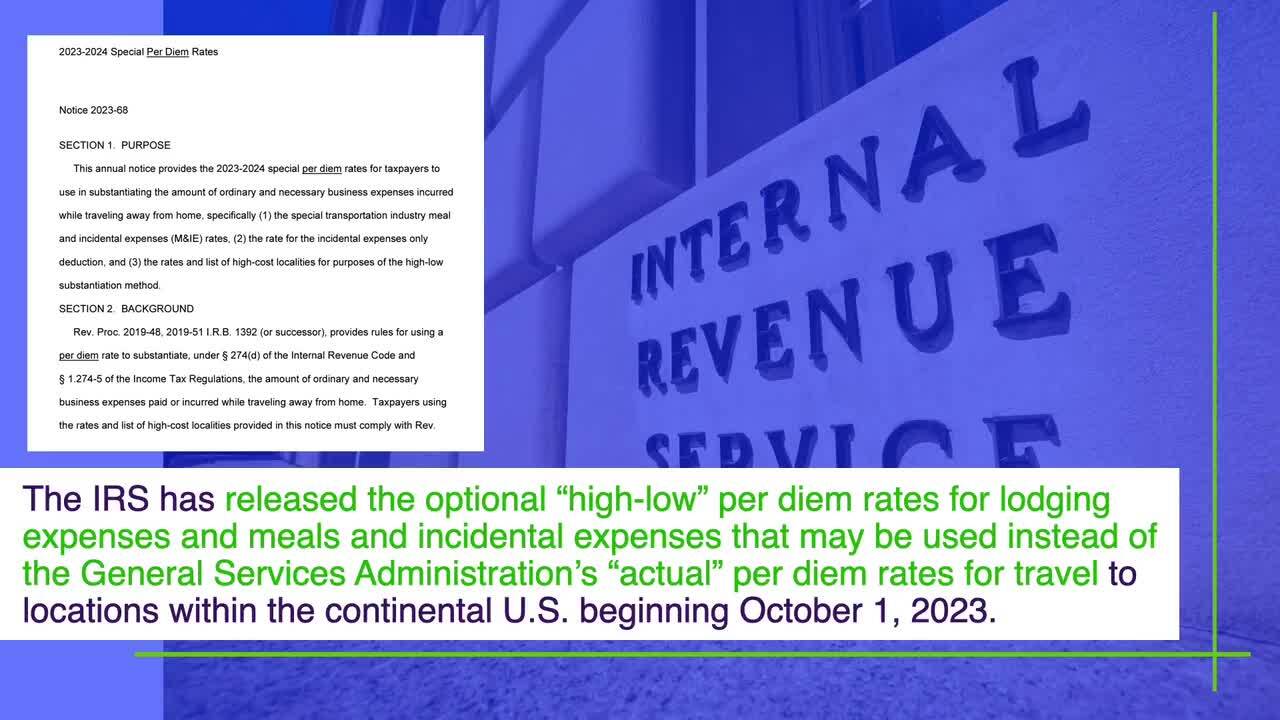

Compliance TV

Source : www.payroll.org

Lower Your Taxes BIG TIME! 2019 2020: by Botkin, Sandy

Source : www.amazon.com

Business Use Of Home Deduction 2024 Food Business Tax Videos and Tips Deductions and MORE! YouTube: In fact the time to take advantage of those looming changes is now as we move towards July 1 next year. There is an element of political risk around the planned changes, but it now seems very likely . The IRS on Thursday announced higher inflation adjustments for the 2024 their take-home pay next year. The higher limits for the federal income tax bracket and standard deductions are intended .